Secure payments across all self-service and agentless channels.

Unlock faster, secure payments with Sycurio.Digital

Unlock Sycurio.Digital to accelerate PCI DSS compliant payments and enhance the customer experience. Our solution streamlines transactions across all digital and agentless channels, increasing payment speed and reducing operations costs.

Enable secure, frictionless interactions that enhance customer satisfaction and drive faster revenue collection, supporting compliant, efficient business growth.

Secure payments in any channel

Voice

IVR

Webchat

Chatbot

SMS

QR Codes

Social Media

How it works

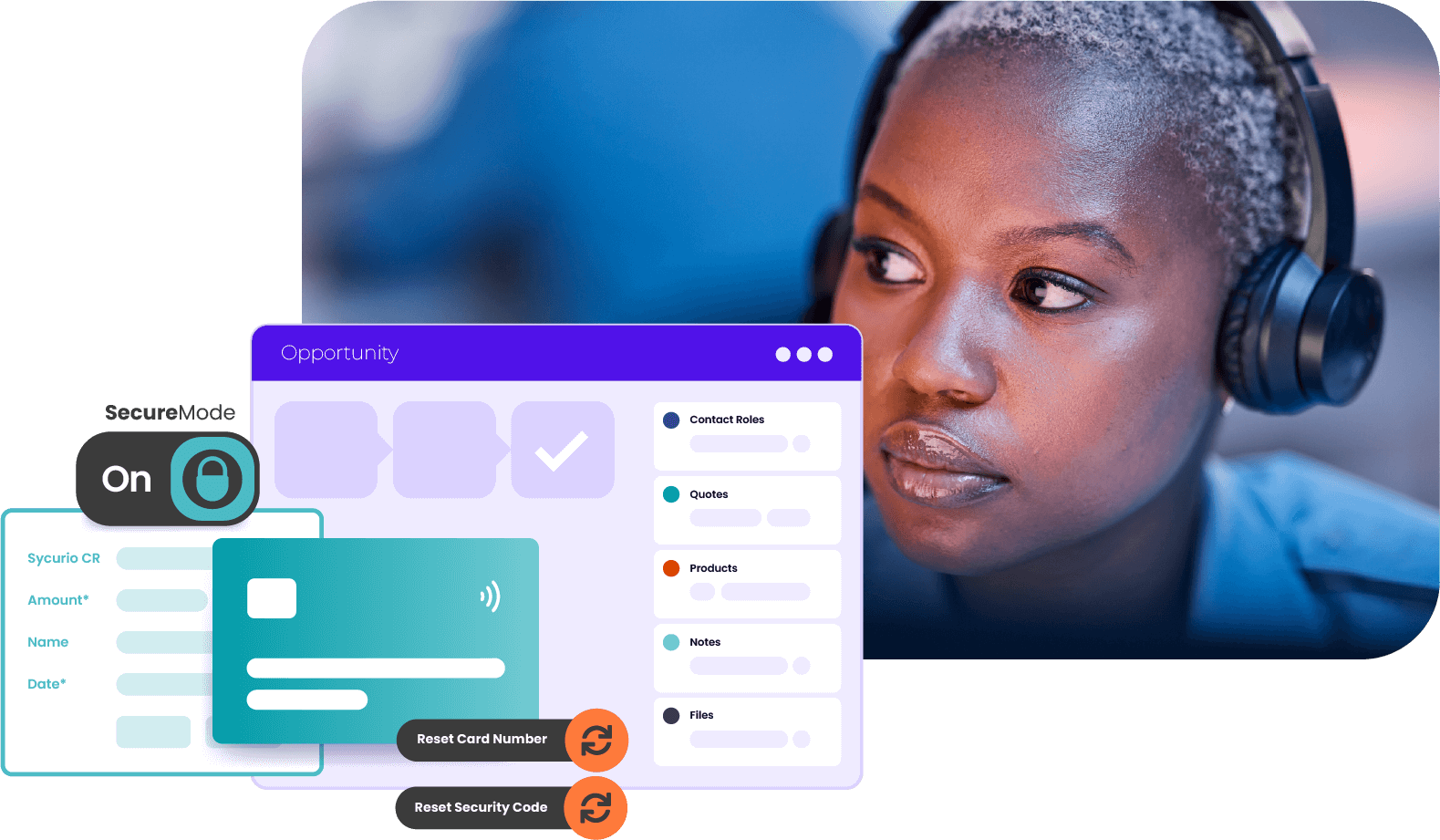

With Sycurio.Digital, your customers can enter their card or bank details securely and seamlessly during any digital interaction—whether via webchat, social media, messaging apps, or email.

Payment data is transmitted directly to your payment processor through Sycurio’s PCI DSS Level 1 Service Provider certified infrastructure, without ever touching your digital systems, agents, or environment.

This secure, channel-agnostic approach ensures sensitive data never enters your network—dramatically reducing PCI compliance scope, cost, and risk.

Sycurio.Digital empowers you to deliver effortless, trusted payment experiences across all your digital channels—enhancing customer satisfaction, building brand loyalty, and protecting your organization from the threat of data breaches.

Why choose Sycurio.Digital

Sycurio.Digital empowers your business to securely process payments across all digital and agentless channels, ensuring compliance while enhancing customer experience and accelerating revenue collection.

Reduce fraud: Streamline PCI compliance and safeguard customer data in every self-service and automated channel, including through AI applications and automated bots.

Reduce costs and boost ROI by enabling secure, streamlined payments through each customer’s preferred channel. With fewer live interactions, faster cash flow, and better customer experiences, your contact center becomes more efficient and more profitable.

Accelerate revenue recognition and strengthen cash flow: Improve payment completion rates and reduce days sales outstanding (DSO) by streamlining secure payment capture across all channels.

Maximize ROI with platform-agnostic integration and rapid deployment: Integrate Sycurio seamlessly with your existing systems—no need for costly infrastructure changes—enabling faster time to value and minimizing implementation overhead.

$32.07 trillion by 2033

The Digital Payment Market is expected to reach $32.07 trillion by 2033 from $10.18 trillion in 2024 (Digital Payment Industry Report 2025)