Secure payments that power the customer experience.

From digital to voice and IVR, Sycurio streamlines enterprise payments and removes the burden of PCI DSS compliance.

Effortless PCI compliance for all payment channels

Meet your customers wherever they are with secure, consistent payment experiences across voice, digital, and IVR.

Sycurio eliminates complexity, so your teams can focus on what matters most: delivering exceptional customer service.

With Sycurio, every payment becomes effortless, in any channel, every time.

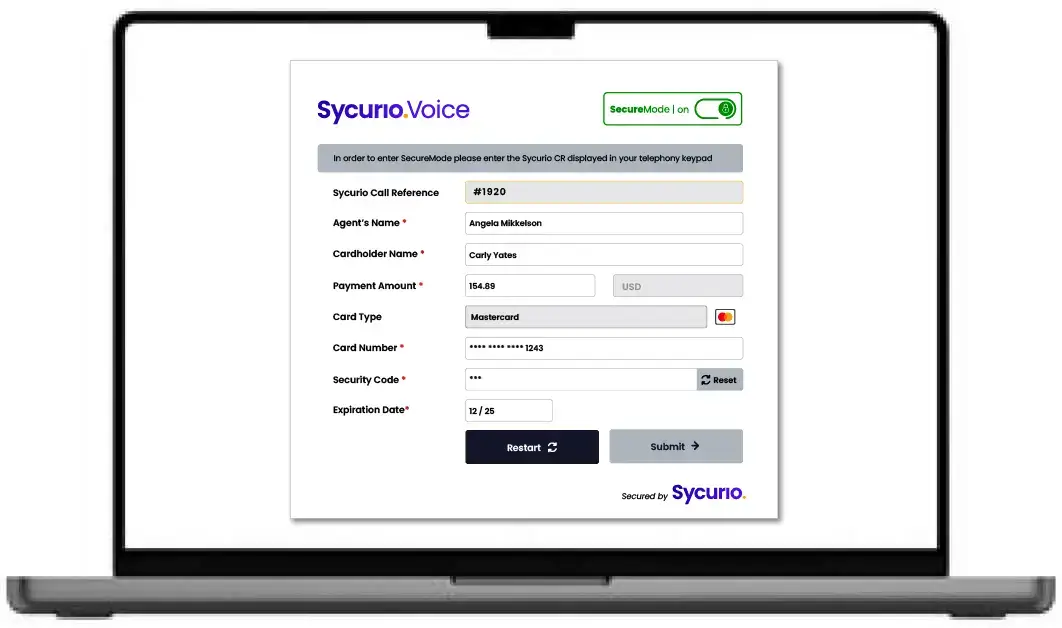

How Sycurio works

Whether handled by your agents or automated systems, Sycurio enables secure, effortless payments across every channel — voice, digital, IVR, AI-powered bots, and more.

All transactions are processed through our PCI DSS Level 1-certified infrastructure, ensuring card data never touches your agents, systems, or networks.

It’s a simple, seamless, and highly secure payment solution for contact centers, remote teams, outsourced partners, through every communication channel.

Built for integration

Sycurio’s solutions are designed for seamless integration with cloud contact centers (CCaaS), CRMs, UCaaS platforms, enterprise networks, carrier-grade telephony, payment gateways, processors, and a wide range of contact center and hosted systems.

Powerful solutions in any channel

Reduce costly and time consuming annual PCI DSS audits

Sycurio’s solutions reduce your PCI DSS scope by moving your merchant status to SAQ-A for all protected voice and digital payments.

Say goodbye to complex, time-consuming audits. With Sycurio, all you need is the simple SAQ-A self-assessment — and we’ll provide your PCI Attestation of Compliance (AOC).

Experience stronger security, significant time and resource savings, and impactful reductions in operational costs.

Improve agent productivity and reduce costs

Sycurio empowers your contact center and remote agents to handle payments more efficiently, helping to streamline operations and elevate customer experience.

By simplifying the payment process, agents can reduce average handling times and resolve payment-related queries on the first call — leading to faster service, shorter queues, and less customer frustration.

With less time spent navigating complex compliance procedures or manually handling sensitive data, your teams can focus on what matters most: delivering exceptional service.

Enhance customer experience and increase revenue

Sycurio enables fast, secure, and frictionless payments — no matter how customers choose to engage. By streamlining the payment process, you accelerate revenue collection and build lasting customer trust.

From live agents to IVRs, digital platforms, and messaging channels, Sycurio ensures a consistent, seamless experience across every touchpoint.

The result? Fewer dropped calls, reduced payment abandonment, and greater satisfaction — all contributing to stronger loyalty and a more trusted brand.

Learn more today

Sycurio understands the challenges of compliance and the importance of seamless customer experiences — and we deliver the solutions to solve both.